• Thailand will be a focus for Changan’s international expansion, carmaker says

• Chinese carmakers’ rush to build plants abroad reflects concerns about escalating competition at home: analyst

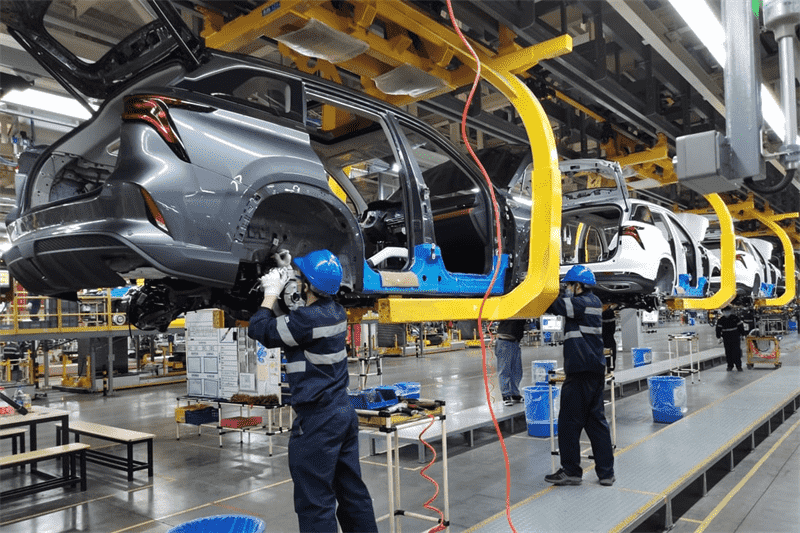

State-owned Changan Automobile, the Chinese partner of Ford Motor and Mazda Motor, said it plans to build an electric-vehicle (EV) assembly plant in Thailand, becoming the latest Chinese carmaker to invest in the Southeast Asian market amid cutthroat domestic competition.

The company, which is based in China’s southwestern Chongqing province, will spend 1.83 billion yuan (US$251 million) to set up a plant with an annual capacity of 100,000 units, which will be sold in Thailand, Australia, New Zealand, the United Kingdom and South Africa, it said in a statement on Thursday.

“Thailand will be a focus for Changan’s international expansion,” the statement said. “With a foothold in Thailand, the company makes a leap forwards in the international market.”

Changan said it would increase capacity at the plant to 200,000 units, but did not say when it will be operational. It also has not announced a location for the facility.

The Chinese carmaker is following in the footsteps of domestic competitors such as BYD, the world’s largest EV maker, Great Wall Motor, mainland China’s largest sport-utility vehicle maker, and EV start-up Hozon New Energy Automobile in setting up production lines in Southeast Asia.

The new factory in Thailand will be Changan’s first overseas facility, and aligns with the carmaker’s global ambitions. In April, Changan said it would invest a total of US$10 billion abroad by 2030, with the aim of selling 1.2 million vehicles a year outside China.

“Changan has set itself a lofty goal for overseas production and sales,” said Chen Jinzhu, CEO of consultancy Shanghai Mingliang Auto Service. “Chinese carmakers’ rush to build plants abroad reflects their worries about escalating competition at home.”

Changan reported sales of 2.35 million vehicles last year, a 2 per cent year-on-year increase. Deliveries of EVs jumped 150 per cent to 271,240 units.

The Southeast Asian market is attracting Chinese carmakers because of its scope and performance. Thailand is the region’s largest car producer and second-largest sales market after Indonesia. It reported sales of 849,388 units last year, an increase of 11.9 per cent year on year, according to consultancy and data provider Just-auto.com.

About 3.4 million vehicles were sold in six Southeast Asian countries – Singapore, Thailand, Indonesia, Malaysia, Vietnam and the Philippines – last year, a 20 per cent rise over 2021 sales.

In May, Shenzhen-based BYD said it had agreed with the Indonesian government to localise the production of its vehicles. The company, which is backed by Warren Buffett’s Berkshire Hathaway, expects the factory to commence production next year. It will have an annual capacity of 150,000 units.

At the end of June, Great Wall said it will establish a plant in Vietnam in 2025 to assemble pure electric and hybrid vehicles. On July 26, Shanghai-based Hozon signed a preliminary pact with Handal Indonesia Motor to build its Neta-branded EVs in the Southeast Asian country.

China, the world’s largest EV market, is crowded with more than 200 licensed EV makers of all shapes and sizes, many of them backed by China’s major technology companies such as Alibaba Group Holding, which also owns the Post, and Tencent Holdings, the operator of China’s biggest social-media app.

The country is also poised to overtake Japan as the world’s largest car exporter this year. According to Chinese customs authorities, the country exported 2.34 million cars in the first six months of 2023, beating the overseas sales of 2.02 million units reported by the Japan Automobile Manufacturers Association.

Post time: Aug-31-2023