Total Capital raised has exceeded 100 billion yuan, and the national sales target of 6 million units set for 2025 has already been exceeded

At least 15 once-promising EV start-ups with a combined annual production capacity of 10 million units have either collapsed or been driven to the verge of insolvency

Vincent Kong waves a soft-bristled brush as he removes dust from his WM W6, an electric sport-utility vehicle whose purchase he has regretted since the time the carmaker’s fortunes took a turn for the worse.

“If WM were to close [due to a financial squeeze], I would be forced buy a new [electric] car to replace the W6 because the company’s after-sale services would be suspended,” said the Shanghai white-collar clerk, who spent about 200,000 yuan (US$27,782) when he bought the SUV two years ago. “More importantly, it would be embarrassing to drive a car built by a failed marque.”

Founded in 2015 by Freeman Shen Hui, former CEO of Zhejiang Geely Holding Group, WM has grappled with financial problems since the second half of 2022 and suffered a blow in early September this year when its US$2 billion reverse-merger deal with Hong Kong-listed Apollo Smart Mobility collapsed.

WM is not the only underachiever in China’s white hot EV market, where as many as 200 licensed carmakers – including the assemblers of petrol-guzzlers who are struggling to migrate to EVs – are battling to gain a foothold. In a car market where 60 per cent of all new vehicles will be electric by 2030, only the assemblers with the deepest pockets, the most dazzling and most frequently updated models, are expected to survive.

This trickle of exits is threatening to turn into a flood with at least 15 once-promising EV start-ups with a combined annual production capacity of 10 million units having either collapsed or been driven to the verge of insolvency as bigger players gained market share, leaving smaller contenders like WM to fight for scraps, according to calculations by China Business News.

EV owner Kong admitted that the 18,000 yuan (US$2,501) government subsidy, exemption from consumption tax which could save over 20,000 yuan and a free car licence plates which entailed a 90,000 yuan in savings, were the key reasons for his purchase decision.

Yet, the 42-year-old middle manager with a state-owned company now feels it was not a wise decision as he may have to spend money on a replacement, were the company to fail.

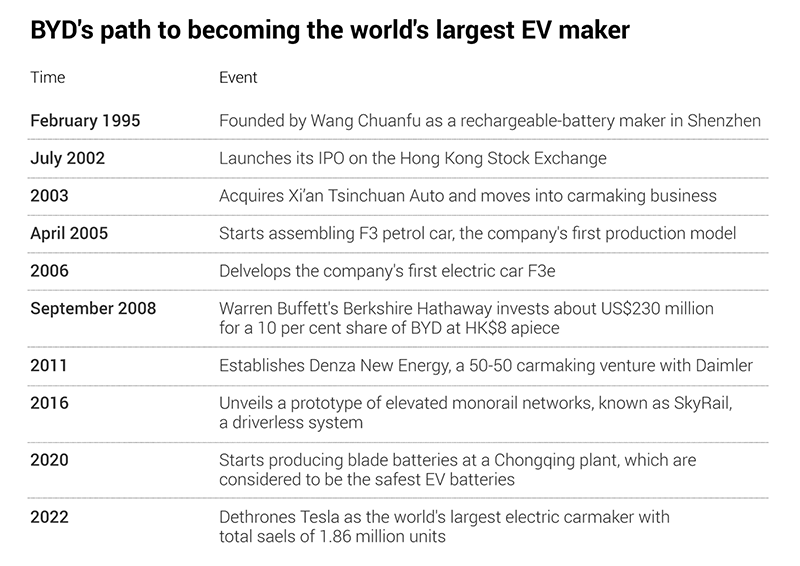

Shanghai-based WM Motor used to be the poster child of the EV boom in China as venture capital and private equity investors poured an estimated 40 billion yuan into the sector between 2016 and 2022. The company, once viewed as a potential rival to Tesla in China, counts Baidu, Tencent, Hong Kong tycoon Richard Li’s PCCW, the late Macau gambling magnate Stanley Ho’s Shun Tak Holdings and high-profile investment firm Hongshan among its early investors.

WM’s failed back-door listing hurt its fundraising ability and came after a cost-cutting campaign under which WM slashed staff salaries by half and shut 90 per cent of its Shanghai-based showrooms. Local media outlets like the state-owned financial newspaper China Business News, reported that WM was close to bankruptcy as it was starved of funds necessary for sustaining its operations.

It has since been revealed that US-listed second-hand car dealer Kaixin Auto would step in as a white knight following an agreement whose value was not disclosed.

“WM Motor’s fashion technology product positioning and branding has a good match with Kaixin’s strategic development goals,” Lin Mingjun, chairman and CEO of Kaixin, said in a statement after announcing the plan to acquire WM. “Through the intended acquisition, WM Motor will gain access to more capital support to enhance the development of its smart mobility business.”

According to the company’s initial public offering prospectus, filed to the Hong Kong stock exchange in 2022, WM posted losses of 4.1 billion yuan in 2019 which widened 22 per cent to 5.1 billion yuan the following year and further to 8.2 billion yuan in 2021 when its sales volumes declined. Last year, WM sold only 30,000 units in the fast-growing mainland market, a decline of 33 per cent.

The large swathe of companies, ranging from WM Motor and Aiways to Enovate Motors and Qiantu Motor, have already established production facilities across mainland China that are able to churn out 3.8 million units a year after total capital raised has exceeded 100 billion yuan, according to China Business News.

The national sales target of 6 million units by 2025, set by the Ministry of Industry and Information Technology in 2019, has already been exceeded. Deliveries of pure electric and plug-in hybrid cars for passenger use in China are expected to jump 55 per cent to 8.8 million units this year, UBS analyst Paul Gong forecast in April.

EVs are estimated to make up about a third of the new car sales volumes in mainland China in 2023, but that may not be enough to sustain operations at many of the EV makers who splash out billions on design, production and sales-related costs.

“In the Chinese market, most EV makers are posting losses due to fierce competition,” said Gong. “Most of them cited higher lithium [a key material used in EV batteries] prices as the major reason for poor performance, but they were not making profits even when the lithium prices were flat.”

The Shanghai Auto Show in April saw WM, along with five other well-known start-ups – Evergrande New Energy Auto, Qiantu Motor, Aiways, Enovate Motors and Niutron – skipping the 10-day showcase event, the nation’s biggest automobile expo.

These carmakers have either closed their factories or stopped taking new orders, as a bruising price war took its toll in the world’s largest automotive and EV market.

In sharp contrast, Nio, Xpeng and Li Auto, the mainland’s top three EV start-ups, drew the biggest crowds to their halls that covered about 3,000 square metres of exhibition space each, in the absence of US carmaker Tesla.

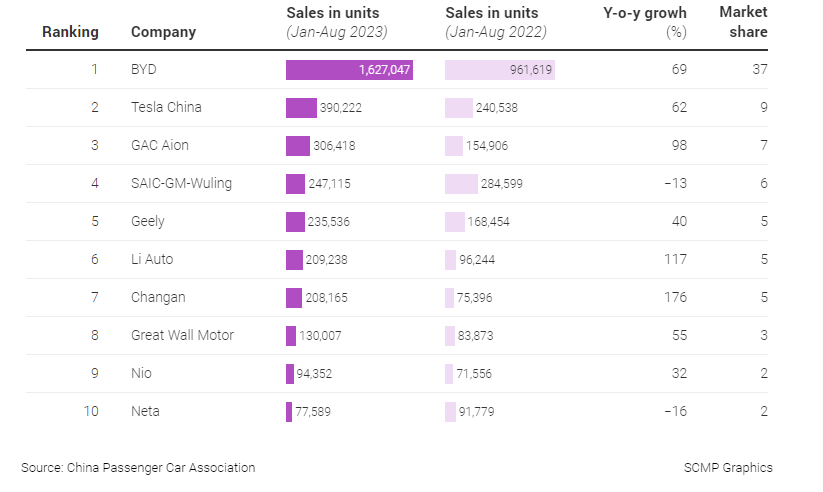

Top EV makers in China

“The Chinese EV market has a high bar,” said David Zhang, a visiting professor at Huanghe Science and Technology College in Zhengzhou, Henan province. “A company has to raise enough funds, develop strong products and needs an efficient sales team to survive the cutthroat market. When any of them grapples with funding strains or lacklustre deliveries, their days are numbered unless they can receive fresh capital.”

China’s economic growth pace has slowed in the past eight years, exacerbated by the government’s so-called zero-Covid strategy which has resulted in job cuts across the technology, property and tourism sectors. That has led to a general decline in spending, as consumers deferred purchases of large-ticket items like cars and real estate.

For EVs specifically, competition is skewed in favour of larger players, who have access to better quality batteries, better designs, and have bigger marketing budgets.

William Li, co-founder and CEO of Nio, predicted in 2021 that at least 40 billion yuan of capital would be required for an EV start-up to become profitable and self-sufficient.

He Xiaopeng, CEO of Xpeng, said in April that only eight electric-car assemblers would remain by 2027, because smaller players would not be able to survive the fierce competition in the fast-growing industry.

“There will be several rounds of huge eliminations (of carmakers) amid the automotive industry’s transition to electrification,” he said. “Every player has to work hard to avoid relegation from the league.”

Neither Nio nor Xpeng has generated a profit yet, while Li Auto has been reporting quarterly profits only since the December quarter last year.

“In a dynamic market, EV start-ups are supposed to create a niche to build their own customer base,” said Nio president Qin Lihong. “Nio, as a premium EV maker, will stand firm in positioning us as a rival to petrol car brands like BMW, Mercedes-Benz and Audi. We are still trying to consolidate our foothold in the premium car segment.”

Smaller players are looking overseas after failing to make significant inroads in the home market. Zhang of Huanghe Science and Technology College said Chinese EV assemblers that were struggling to gain a foothold in the home market were heading abroad in a bid to lure new investors, as they battled to survive.

Zhejiang-based Enovate Motors, which does not rank among the top Chinese EV makers, announced a plan to build a factory in Saudi Arabia, following a state visit by President Xi Jinping to the kingdom earlier this year. The carmaker, which counts Shanghai Electric Group as an early investor, signed an agreement with Saudi Arabian authorities and joint-venture partner Sumou to set up an EV plant with an annual capacity of 100,000 units.

Another minor player, Shanghai-based Human Horizons, a luxury EV maker that assembles cars priced at US$80,000, established a US$5.6 billion venture with Saudi Arabia’s investment ministry in June to conduct “automotive research, development, manufacturing and sales”. Human Horizon’s sole brand HiPhi does not feature in the list of China’s top 15 EVs in terms of monthly sales.

“The more than a dozen failed carmakers have opened the floodgates for hundreds of losers to surface in the coming two to three years,” said Phate Zhang, founder of CnEVPost, a Shanghai-based electric-vehicle data provider. “Most of the small EV players in China, with financial and policy support from local governments, are still struggling to develop and build next-generation electric cars amid China’s carbon neutrality goal. But they are set to fizzle out once they run out of funds.”

Byton, an EV start-up backed by Nanjing city government and state-owned carmaker FAW Group, filed for bankruptcy in June this year after it failed to kick off production of its first model, the M-Byte sport-utility vehicle which made its debut in the Frankfurt Motor Show in 2019.

It never delivered a finished car to customers while its main business unit, Nanjing Zhixing New Energy Vehicle Technology Development, was forced into bankruptcy after being sued by a creditor. This follows last year’s bankruptcy filing by Beijing Judian Travel Technology, the joint venture between Chinese ride-hailing giant Didi Chuxing and Li Auto.

“Rainy days are ahead for those small players which do not have strong investors to support their car design and manufacturing,” said Cao Hua, a partner at Shanghai-based private equity firm Unity Asset Management, which invests in vehicle supply-chain firms. “EV is a capital-intensive business and it carries high risks for companies, particularly those start-ups which have not built up their brand awareness in this highly competitive market.”

Post time: Oct-09-2023