Global sales of electric vehicles broke records last year, led by China, which has solidified its dominance of the world electric vehicle market. While the development of electric vehicles is inevitable, strong policy support is needed to ensure sustainability, according to professional bodies. An important reason for the rapid development of China’s electric vehicles is that they have achieved an obvious first-mover advantage by relying on forward-looking policy guidance and strong support from the central and local governments.

Global electric vehicle sales broke records last year and continue to grow strongly in the first quarter of 2022, according to the Latest Global Electric Vehicle Outlook 2022 from the International Energy Agency (IEA). This is largely due to the supportive policies adopted by many countries and regions. Statistics show that about 30 billion U.S. dollars was spent on subsidies and incentives last year, double the previous year.

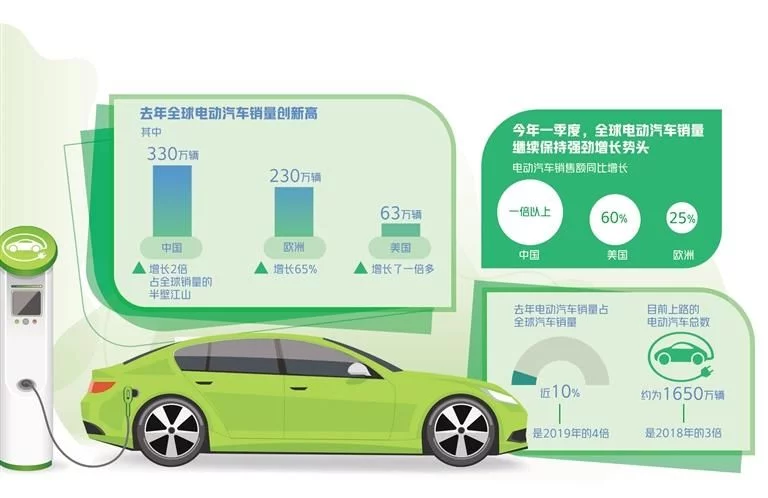

China has seen the most progress in electric vehicles, with sales trebling to 3.3m last year, accounting for half of global sales. China’s dominance of the world electric vehicle market is becoming more entrenched.

Other electric car powers are hot on their heels. Sales in Europe rose 65% last year to 2.3m; Sales of electric vehicles in the US more than doubled to 630,000. A similar trend was seen in the first quarter of 2022, when ev sales more than doubled in China, 60 percent in the U.S. and 25 percent in Europe compared with the first quarter of 2021. Market analysts believe that despite the impact of COVID-19, global ev growth remains strong, and major auto markets will see significant growth this year, leaving a huge market space for the future.

This assessment is backed up by the IEA’s data: global electric and plug-in hybrid vehicle sales doubled in 2021 compared with 2020, reaching a new annual record of 6.6 million vehicles; Sales of electric vehicles averaged more than 120,000 a week last year, the equivalent of a decade ago. Overall, nearly 10 percent of global vehicle sales in 2021 will be electric vehicles, four times the number in 2019. The total number of electric vehicles on the road now stands at about 16.5m, three times as many as in 2018. Two million electric vehicles were sold globally in the first quarter of this year, up 75% from the same period in 2021.

The IEA believes that while the development of electric vehicles is inevitable, strong policy support is needed to ensure sustainability. Global resolve to tackle climate change is growing, with a growing number of countries pledging to phase out the internal combustion engine over the next few decades and setting ambitious electrification targets. At the same time, the world’s major automakers are stepping up investment and transformation to achieve electrification as soon as possible and compete for a bigger market share. According to incomplete statistics, the number of new electric vehicle models launched globally last year was five times that of 2015, and there are currently about 450 electric vehicle models on the market. The endless stream of new models also greatly stimulated consumers’ desire to buy.

The rapid development of Electric vehicles in China mainly relies on forward-looking policy guidance and strong support from the central and local governments, thus obtaining obvious first-mover advantages. In contrast, other emerging and developing economies still lag behind in electric vehicle development. In addition to policy reasons, on the one hand, China lacks the capacity and speed to build strong charging infrastructure; On the other hand, it lacks a complete and low-cost industrial chain unique to the Chinese market. High car prices have made new models unaffordable for many consumers. In Brazil, India and Indonesia, for example, electric vehicle sales account for less than 0.5% of the total car market.

Still, the market for electric cars is promising. Some emerging economies, including India, saw a surge in electric vehicle sales last year, and a new turnround is expected in the next few years if investments and policies are in place.

Looking ahead to 2030, the IEA says the world’s prospects for electric vehicles are very positive. With current climate policies in place, electric vehicles will account for more than 30 percent of global vehicle sales, or 200 million vehicles. In addition, the global market for electric vehicle charging is also expected to see huge growth.

However, there are still many difficulties and obstacles to overcome. The amount of existing and planned public charging infrastructure is far from adequate to meet demand, let alone the scale of the future ev market. Urban grid distribution management is also a problem. By 2030, digital grid technology and smart charging will be key for evs to move from addressing the challenges of grid integration to capturing the opportunities of grid management. This is of course inseparable from technological innovation.

In particular, key minerals and metals are becoming scarcer amid a worldwide scramble to develop electric vehicles and clean technology industries. The battery supply chain, for example, faces big challenges. Prices of raw materials such as cobalt, lithium and nickel have soared due to the conflict between Russia and Ukraine. Lithium prices in May were more than seven times higher than at the beginning of last year. That is why the United States and the European Union have been increasing their own production and development of car batteries in recent years to reduce their dependence on the East Asian battery supply chain.

Either way, the global market for electric vehicles will be vibrant and the most popular place to invest.

Post time: Jul-21-2022